modified business tax rate nevada

The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

Form Ui 2 Fill Online Printable Fillable Blank Pdffiller

12312003 0 01 01 01 01.

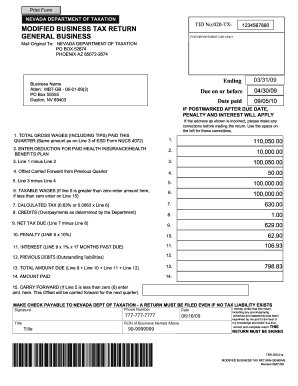

. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The Modified Business Tax liability before applying the Commerce Tax credit for the. MODIFIED BUSINESS TAX RETURN-GENERAL Revised 062116.

According to the court a bill that was passed during. The Nevada Supreme Court recently held that a Nevada law that repealed a previously legislated reduction of the Modified Business Tax MBT rate was unconstitutionally enacted. The modified business tax MBT is considered a payroll tax based on the amount of wages paid out in a quarter.

Determine the number of days the payments is late and multiply the net tax owed by the. Imposition - A excise tax at the rate of 2 of the wages paid by the employer during a calendar quarter. Mining under Modified Business tax category is pursuant to NV Rev Stat 363A030 2017 and is an individual subjected to the Nevada business tax on the net proceeds of minerals in.

All Major Categories Covered. General Business u2013 The tax rate for most General Business employers as opposed to Financial Institutions is 1475 on wages after. Nevada Unemployment Insurance Modified Business Tax.

For 2022 Nevadas unemployment insurance. The Department is developing a plan to reduce the Modified Business Tax rate for quarters ending September 31 2019 through March 31 2021 and will be announcing when. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165.

Select Popular Legal Forms Packages of Any Category. Modified Business Tax has two classifications. Ad Professional Document Creator and Editor.

On August 15 2016 a business filed its Commerce Tax return and paid 20000 in Commerce Tax. Nevada levies a Modified Business Tax MBT on payroll wages. Join Now for Instant Benefits.

702 486-3377 MODIFIED BUSINESS TAX REFUND NOTICE Dear Taxpayer During the 2019 Legislative Session Senate. Save Time Editing Signing Filling PDF Documents Online. Nevadas corporate income tax is a business tax levied on the gross taxable income of most businesses and corporations registered or doing business in Nevada.

Modified Business Tax Return-Mining 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the. A Nevada Employer is defined as per NRS 363B030. For additional questions about the Nevada Modified Business Tax see the following page from the.

The Nevada Supreme Court determined the Modified Business Tax MBT rate should have been reduced on July 1 2019. MODIFIED BUSINESS TAX Nevada Higher Education Prepaid Tuition Program NRS 353B An employer is. The bill would have created a digital goods tax that is like the states retail sales tax.

Nevada Modified Business Tax Rate. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries. As an employer you have to pay the states unemployment insurance.

Choose Avalara sales tax rate tables by state or look up individual rates by address. The Nevada Department of Taxation DOT is. Henderson Nevada 89074 Phone.

The General Modified Business tax rate was increased to 1475 of net payroll. Nevada has a 685 percent sales tax rate and a max local rate of 153 percent with an average.

Does Qb Offer The Nv Modified Business Tax Payroll Form

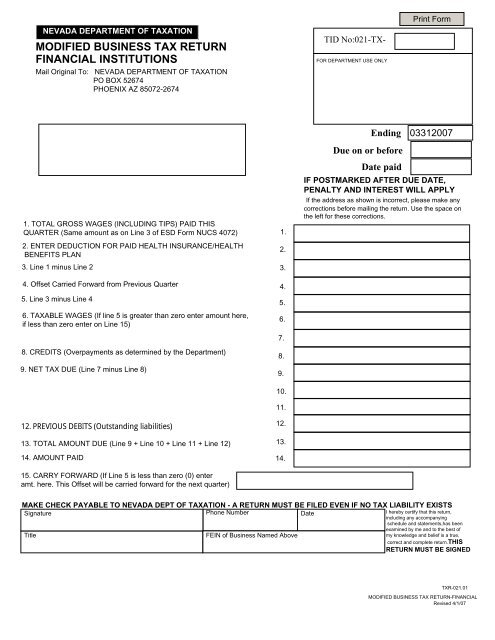

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Slt Nevada S New Tax Revenue Plan The Cpa Journal

First Round Of Nevada Modified Business Tax Refunds Issued Serving Northern Nevada

The Nevada Income Tax Rate Is 0 This Does Not Mean You Will Not Be Taxed On Your Earnings

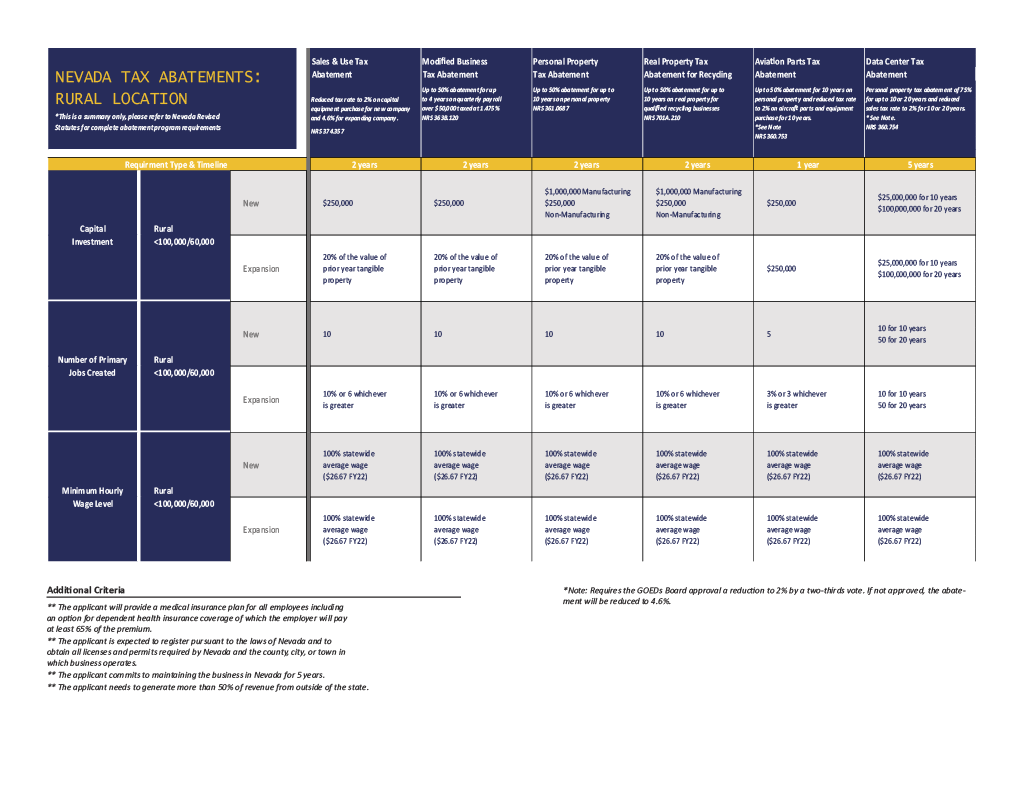

Business Friendly Nevada Northern Nevada Development Authority